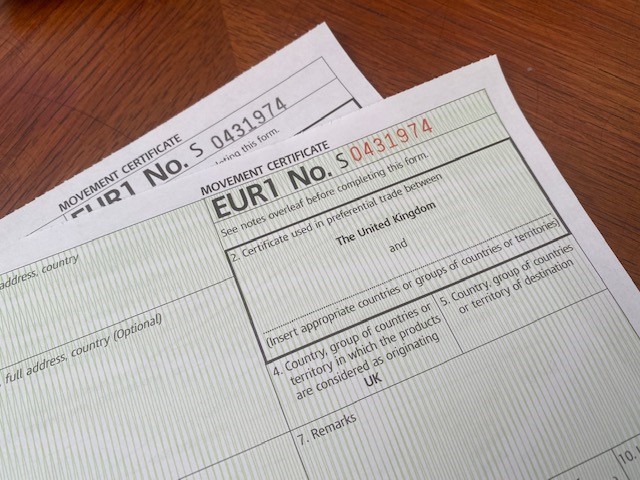

UK EUR1 Movement Certificate

This is a preference document which is used by UK companies to support claims for nil or preferential duty rates at the country of importation which the UK has a trade agreement with. GM Chamber is authorised by HM Revenue & Customs to issue EUR1s Certificates and we can work with any exporter across the UK.

HOW DO I APPLY FOR AN UK EUR1?

- Make sure you have your HS code/commodity code at hand for the products you are exporting, and if in doubt you can check the UK's Tariff tool

- Using the UK's How to export online tool, verify if there is a trade agreement in place with the country of importation and what rules of origin you must comply with to access nil or reduced duties, as well as what proof you must provide to your importer

- Email the team at exportdocs@gmchamber.co.uk or call at 0161 393 4314 | 489 3170 to order some forms.

- Please refer to our certification service levels before submitting. If you need these urgently, make sure to opt for our priority or premium priority.

- Companies can apply manually using some blank forms ordered from us, or via e-Cert.

- When submitting via eCert, you can opt for Express (accepted by most countries) or Standard. For a list of countries for which only standard application can be made, click here. You will need to have blank forms from us, pre-sign and return.

- Check our current and 2025-26 pricing list here

Should you require an agent authority letter for your EUR1 document please see a template for this here - please note this must be reproduced on your business' own letterhead.

Need more help completing your UK COO?

Book a one to one session with a member of our team emailing us at international@gmchamber.co.uk or call 0161 393 4314, or visit our Event's section to check what UK COOs and EUR1 Step by Step workshops we have coming up.

If you have other enquiries about your application email us at exportdocs@gmchamber.co.uk. Due to high volume of queries, please take note that if you apply for a standard services, our turnaround is 48 hrs, so please check e-Cert before following up with our team on email or over the phone.

We value your feedback and is paramount to us for improving our services. Please complete this short 1-min satisfaction survey.